44+ rising rates are battering mortgage lenders

Skip The Bank Save. Lock Rates For 90 Days While You Research.

Big Mortgage Lenders Are Flirting With Disaster American Banker

Compare More Than Just Rates.

. Others are trying to drum up business by offering lower rates or cutting their fees. Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. Use Our Comparison Site Find Out Which Lender Suites You The Best.

Estimate Your Monthly Payment Today. Protect Yourself From a Rise in Rates. While the latter is still a competitive rate in.

Ad Best Home Loans Interest Rates Comparison. Web The ten lenders with the best mortgage rates on average are. Web Mortgage lenders typically offer lower interest rates to borrowers who go shorter than 30 years because the shorter term means the lender recoups its investment.

Mphasis Expects Weak Us Mortgage Business To Weigh. Lock Your Rate Today. Web The law also gave lenders an incentive to offer qualified mortgages or loans designed to be easy for borrowers to understand and to have predictable.

Ad Take Advantage Of These Low Rates Today. Ad More Veterans Than Ever are Buying with 0 Down. Web Rising Rates Are Battering Mortgage Lenders The Wall Street Journal May 25 2022.

Get Instantly Matched With Your Ideal Mortgage Lender. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web While mortgage rates are directly impacted by US.

The 30-year rates could jump above 4 this year but thats still low. Apply Online Get Pre-Approved Today. Ad Compare the Best Home Loans for February 2023.

Apply Easily And Get Pre Approved In Minutes. View Insights To Help Navigate Rate Environments. Find A Lender That Offers Great Service.

The issue we are facing now is that the unsustainable gold rush of historically low interest. Apply Get Pre-Approved Today. Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise.

Ad Stay On Course As Interest Rates Shift. Web Its so easy to forget the times when the interest rates never dropped below 6-7 percent. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Learn More About Our Insights And Strategy Around Short-Term And Long-Term Interest Rates. Apply Get Pre-Approved Today. Web Mortgage rates were at record lows in 2020 and 2021 but theyve been increasing in 2022.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Rising Rates Are Battering Mortgage Lenders ABI Rising Rates Are Battering Mortgage Lenders Wednesday May 25 2022 Article Tags. Web Mortgage Rate Increase Hits Lenders as Refinancing Surge Fizzles The phones are going quiet for many home-loan brokers Thirty-year fixed mortgage is at.

Ad Compare the Best Home Loans for February 2023. Web On Jan. Dont Settle Save By Choosing The Lowest Rate.

Treasury bond yields rising inflation and the Feds actions to contain it by hiking the federal funds rate tend to. Web Rising Rates Are Battering Mortgage Lenders Summary by Wall Street Journal Mortgage lenders are scrambling to survive a sharp drop-off in the number of. Web She is stating that we need at least 20 down but that our interest rate is going to be between 2-4 higher than the current average mortgage rates even with 20 down.

Ad Compare Best Mortgage Lenders 2023. Web Wall Street Journal May 25 2022Orla McCaffrey subscriptionMortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners. 14 the interest rate jumped to 2856.

Web Mortgage lenders are scrambling to survive a sharp drop-off in the number of homeowners refinancing their loans with demand drying up as interest rates rise. Web Some lenders are selling assets such as their rights to collect mortgage payments. Apply For Mortgage Today.

Web WASHINGTON March 10 2022 PRNewswire -- A majority of mortgage lenders continue to expect near-term profitability to decrease amid rising mortgage. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. 1 the average interest rate for a 30-year mortgage was 2765.

British Mortgage Lenders Well Placed To Cope Even In Brexit Doomsday Scenario S P Global Market Intelligence

Mortgage Refinance Demand Plunges 14 As Interest Rates Spike Higher

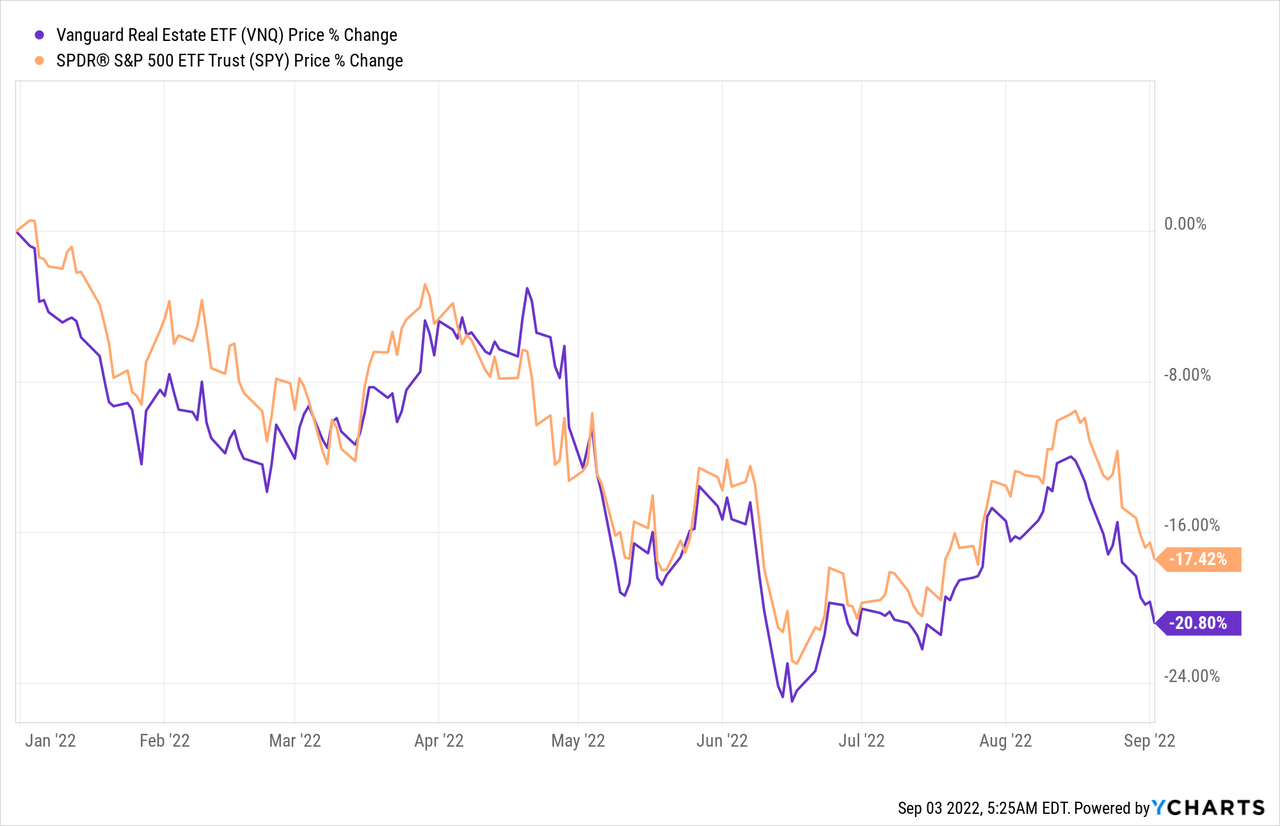

Your Reits Will Vanish Seeking Alpha

Rising Rates Are Battering Mortgage Lenders Wsj

Pdf Money For Nothing And Checks For Free Recent Developments In U S Subprime Mortgage Markets

Watch Bloomberg Markets 11 18 2022 Bloomberg

Demand For Riskier Home Loans Is High As Interest Rates Soar

Mortgage Interest Rates Mortgage Business Fall By More Than 40 Owing To Surge In Interest Rates The Economic Times

Rising Rates Are Battering Mortgage Lenders Wsj

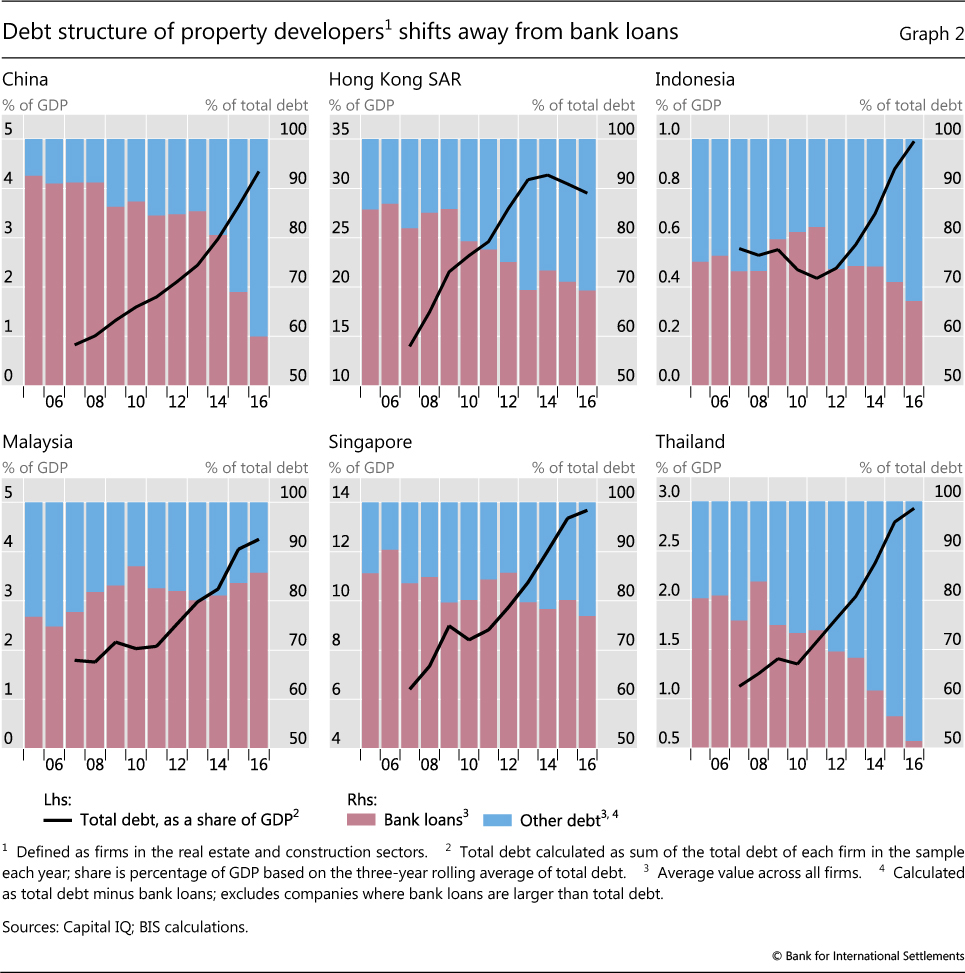

Mortgages Developers And Property Prices

Easing Property Policies Can Support Economic Recovery Global Times

Summer Mortgage Price War Breaks Out As Lenders Reveal A String Of Offers Below 1 Daily Mail Online

Rising Rates Are Battering Mortgage Lenders R Rebubble

Mortgage Bank How Does A Mortgage Bank Work With Example

Latest Us Inflation Data Raises Questions About Fed S Interest Rate Hikes Us Economy The Guardian

Rising Rates Are Battering Mortgage Lenders Wsj

Fed S Rate Hikes Are Tanking The Mortgage Market American Banker